- Our Services

- About Us

- FAQs

- Resources

- In the News

- Careers With Us

- Contact

- Signup

- Self-Managed Super Funds

Oliver's Insights

MBA Financial Strategists•Oliver's Insights

Oliver's Insights

Introduction As widely expected the RBA left interest rates on hold at their August Board meeting. While it appears to retain an easing bias with its assessment that growth is “below longer-term averages” and that the economy is likely to have “a degree of spare capacity for some time yet”, it appeared to soften this...Read More

Since its 2011 high, the Australian dollar has fallen 34% in value against the US dollar. For some time our view has been that it will fall to $US0.70 by year end with probably an overshoot into the $US0.60s. However, as we all know forecasting precise currency levels is a mug’s game. The key is...Read More

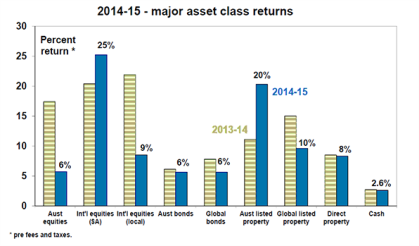

Introduction Despite the usual turmoil along the way and ending on a weak note with Greek and Chinese-related turmoil, 2014-15 provided another year of solid returns for investors who were prepared to move beyond cash. Most asset classes had reasonable returns resulting in average superannuation funds returning 9.9%, their third financial year in a row...Read More

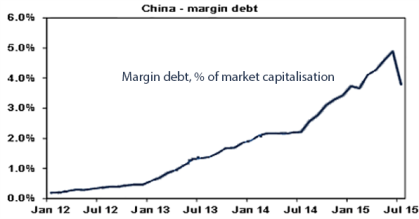

China’s share market volatility

July 15, 2015arc_admin

Introduction It seems western commentators can always find something to worry about regarding China. Last year it was shadow banking and the property market. Lately it’s been the sharp rise and pullback in its share market. The latter has indeed been severe – with a 32% fall over 3 and a half weeks. There have...Read More

Greece after the “No” vote

July 6, 2015arc_admin

I am now getting very wary about going on holidays because invariably markets hit a rough patch whenever I do. That has certainly been the case over the past week with both a sharp pull back in Chinese shares and an intensification of uncertainty regarding Greece. Two weeks ago it looked like Greece was heading...Read More

Is Greece pulling back from the brink?

June 24, 2015arc_admin

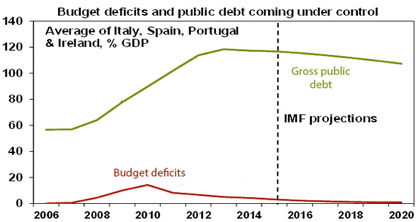

Introduction It’s now coming up to six years since Greece first revealed that it had understated its true level of public debt. And this is the fourth year in which it has seemingly held global financial markets to ransom as a result of its excessive public debt level. To be honest it’s becoming a bit...Read More

Tax concessions and tax reform in Australia

June 19, 2015arc_admin

Introduction Tax reform is a hot topic in Australia with lots of strongly-held views. There are three main reasons. First, despite the tax reforms of the 1980s, 1990s and 2000s the Australian tax system is still far from ideal. This is highlighted by the Government’s Tax Discussion Paper. Second, some see tax reform as a...Read More

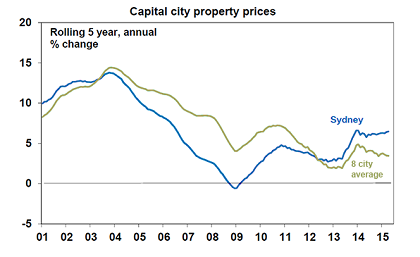

There is even talk of lenders managing their exposure by focussing on postcodes. This is all in response to increasing pressure from the banking regulator APRA (the Australian Prudential Regulation Authority) demanding that the 10% cap on property investor lending growth that it announced last December be adhered to. Those who have been around for...Read More

News Source

Your privacy is important to us and AMP Financial Planning Pty Limited ABN 89 051 208 327 Australian Financial Services Licensee and Australian Credit Licensee No. 232706, which is part of AMP. You may request access to your personal information at any time by calling us on (08) 8357 3999 or contacting AMP on 1300 157 173. Information collected will be subject to AMP's Privacy Policy. You can also contact us or AMP if you do not wish to receive information about products, services or offers available from us or AMP from time to time.