- Our Services

- About Us

- FAQs

- Resources

- In the News

- Careers With Us

- Contact

- Signup

- Self-Managed Super Funds

Market Watch

MBA Financial Strategists•Market Watch

Market Watch

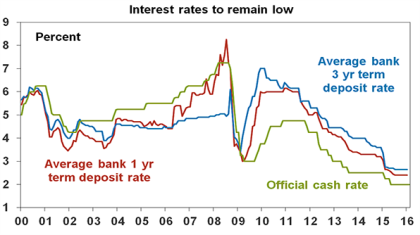

An investment environment of constrained economic growth and high volatility means that interest rates are likely to remain lower for longer – with central banks globally cutting interest rates or leaving them on hold at low levels. Low interest rates bring to the spotlight the potential to gain yield from investments, rather than just focussing...Read More

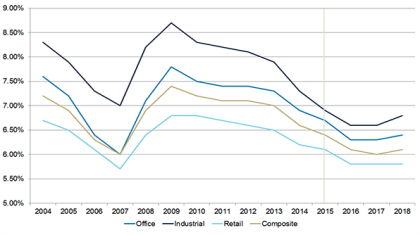

Commercial real estate is a popular choice among Australian and foreign investors given the current low interest rate environment. At a time when the value of global bond yields is low, defensive investors are searching elsewhere for yield and property is an attractive option; particularly those assets that have provided an income guarantee. Due to...Read More

Opportunities to capitalise on a rising demand for food – driven by population and economic growth in Asia – coincides with opportunities and risks related to changing consumer trends. However, there is also currently an increasing obesity issue and the food and beverages sector is exposed to a number of other sustainability issues. AMP...Read More

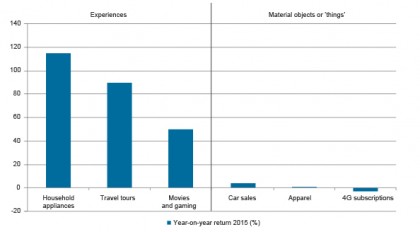

A shift is taking place within the Chinese consumer market – and developed markets more broadly – to spend money on experiences rather than on traditional material products. For the Australian market, this means a boost to tourism from Chinese nationals and to the education and housing sectors from Chinese immigrants. An evolving trend within...Read More

Global investor demand for real assets – including infrastructure equity, infrastructure debt, listed infrastructure, listed real estate and direct real estate – is expected to strengthen this year, with a number of themes set to influence this sector. In this article, we discuss these themes in relation to the particular assets. AMP Capital’s infrastructure and...Read More

While the unconventional gas industry can provide a significant economic benefit to rural and regional areas, there are environmental and social issues that must be addressed. In this article we look at some of these issues and examine why and how the industry can build the trust of stakeholders. Unconventional gas’ has lower greenhouse gas...Read More

As 2015 draws to a close, investors can be forgiven for wondering how they are going to continue to make money in financial markets. Cash rates globally are low and are likely to remain so, especially in Australia. This article looks at a ‘back to basics’ investment strategy suitable for a low-growth environment. Despite the...Read More

The investment environment today is dominated by two themes – rock bottom bond yields and seemingly permanent sluggish growth. Regardless of what one believes about the future, it is likely that diversified investment returns are going to be lower over the next few years than what they have averaged over the last couple of decades....Read More

Financial companies make up the largest portion of the Australian share market at 47.7% of the ASX200 index1. In the wake of the mining downturn, bank share prices have benefited from their robust reputation for high profits and dividends. In light of this, our Environmental Social and Governance (ESG) research team set out to discover...Read More

All four major banks increased interest rates during October, citing their reason for the rate hike due to increased pressure from the Australian Prudential Regulation Authority (APRA) for financial institutions to adhere to the 10% cap on property investor lending growth. Given that we are set to be operating in a low-growth environment for the...Read More

News Source

Your privacy is important to us and AMP Financial Planning Pty Limited ABN 89 051 208 327 Australian Financial Services Licensee and Australian Credit Licensee No. 232706, which is part of AMP. You may request access to your personal information at any time by calling us on (08) 8357 3999 or contacting AMP on 1300 157 173. Information collected will be subject to AMP's Privacy Policy. You can also contact us or AMP if you do not wish to receive information about products, services or offers available from us or AMP from time to time.