- Our Services

- About Us

- FAQs

- Resources

- In the News

- Careers With Us

- Contact

- Signup

- Self-Managed Super Funds

Market Watch

MBA Financial Strategists•Market Watch

Market Watch

Advisers who moved their clients into listed real estate after the GFC made a brave call, given that investors in the sector suffered terribly during the economic turmoil. However, in the last five years, those clients who were invested in the listed real estate sector have benefited from strong total returns. Notably, global listed real...Read More

At its meeting today, the Board decided to leave the cash rate unchanged at 1.50 per cent. The global economy is continuing to grow, at a lower than average pace. Labour market conditions in the advanced economies have improved over the past year. Economic conditions in China have steadied, supported by growth in infrastructure and...Read More

There’s no escaping a lacklustre return potential

December 5, 2016arc_admin

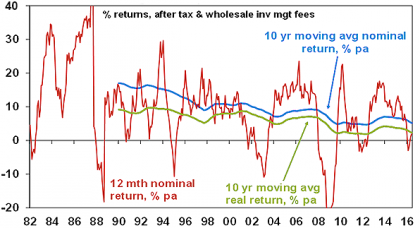

While the high inflation of the 1970s and early 1980s was bad for investment returns at the time, it left a legacy of very high investment yields which helped set the scene for high investment returns through the 1980s and 1990s. Back in the early 1980s the RBA’s ‘cash rate’ was averaging around 14%, three-year...Read More

Trump vs Clinton: The impact on markets

November 7, 2016arc_admin

The United States (US) presidential election, on 8 November, between Republican candidate Donald Trump and Democratic candidate Hillary Clinton is a hotly contested race. More recently, we have seen some widening of opinion polls, however, this is a fluid and fast moving landscape and political uncertainty remains. We anticipate that the potential for increased market...Read More

At its meeting today, the Board decided to leave the cash rate unchanged at 1.50 per cent. The global economy is continuing to grow, at a lower than average pace. Labour market conditions in the advanced economies have improved over the past year, but growth in global industrial production and trade remains subdued. Economic conditions...Read More

After seven years of interest rate cuts and trillions of dollars in quantitative easing, discussion is growing over whether monetary policy is losing its effectiveness, given the growth outlook for advanced economies remains below 2%. These measures have fallen short of stoking inflation to the degree major central banks had hoped, leaving economic growth sluggish...Read More

At its meeting today, the Board decided to leave the cash rate unchanged at 1.50 per cent. The global economy is continuing to grow, at a lower than average pace. Labour market conditions in the advanced economies have improved over the past year, but growth in global industrial production and trade remains subdued. Actions by...Read More

How disruption brings investment risk and opportunity

September 20, 2016arc_admin

Businesses that have succeeded for decades will become unseated by innovative start-ups and tech companies if they don’t adapt to rapid change. At AMP Capital, we looked at the potential impact driverless cars will have on insurers and the economy. Disruption is proving to be a buzz word of 2016. Airbnb, Uber and Tesla have...Read More

At its meeting today, the Board decided to leave the cash rate unchanged at 1.50 per cent. The global economy is continuing to grow, at a lower than average pace. Several advanced economies have recorded improved conditions over the past year, but conditions have become more difficult for a number of emerging market economies. Actions...Read More

EOFY: how have markets performed?

July 17, 2016arc_admin

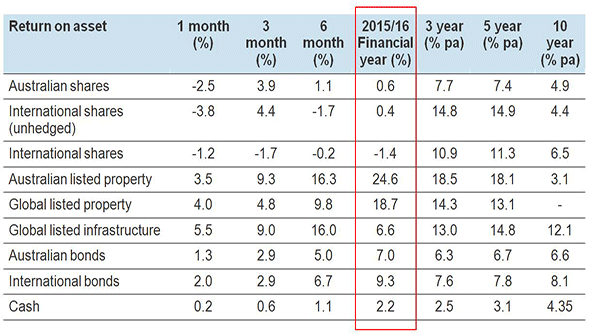

Debbie Alliston, Head of Multi-Asset Portfolio Management, AMP Capital. Volatile and weak sharemarkets Sharemarkets were volatile during 2015/16 and delivered poor returns for the period. Sharemarket performance was adversely impacted by a number of concerns, including falling commodity prices and lacklustre global growth. Of particular note, economic growth in China has been weaker than expected;...Read More

News Source

Your privacy is important to us and AMP Financial Planning Pty Limited ABN 89 051 208 327 Australian Financial Services Licensee and Australian Credit Licensee No. 232706, which is part of AMP. You may request access to your personal information at any time by calling us on (08) 8357 3999 or contacting AMP on 1300 157 173. Information collected will be subject to AMP's Privacy Policy. You can also contact us or AMP if you do not wish to receive information about products, services or offers available from us or AMP from time to time.