- Our Services

- About Us

- FAQs

- Resources

- In the News

- Careers With Us

- Contact

- Signup

- Self-Managed Super Funds

How to invest responsibly and ethically

How to invest responsibly and ethically

If you’d like your money to make a difference to the world as well as your future, responsible investing may be for you.

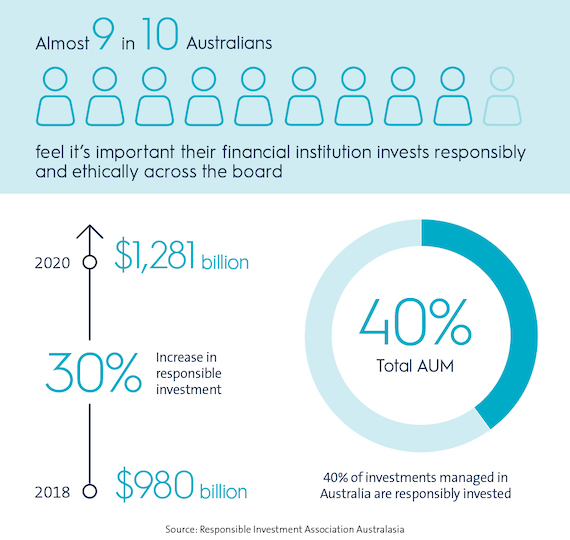

Almost 9 in 10 (89%) Australians feel it’s important their financial institution invests responsibly and ethically across the board1.

Ethical, social and governance (ESG) investments accounted for $1,281 billion—or 40%—of assets under management in Australia at the end of 20202, growing at 15 times the rate of the overall investment market.

What is responsible investing?

As we continue to battle the extremes of bushfires, drought and floods, consumers are increasingly looking for investment managers to take into account ESG issues as well as financial performance.

While environmental concerns are a hot topic, ESG investing also encompasses social issues, as well as how companies make decisions and manage risks.

- Environmental issues—climate change, carbon emissions, waste production, pollution, management of natural resources.

- Social concerns—working conditions, human rights, community engagement, health and safety, employee relations, diversity.

- Governance of companies—executive pay, political lobbying, bribery and corruption, board diversity and structure, tax strategy.

How does ESG investing work?

There are plenty of ways investment managers incorporate ESG into their processes—two common methods are negative and positive screening.

- Negative screening is where investment managers exclude companies or sectors based on specific ESG criteria for example those involved in controversial or unethical business practices, such as human rights abuses, animal testing or selling harmful products like firearms and tobacco.

- Positive screening is where investment managers look for companies or sectors with a strong record in positive solutions and sustainable practices such as renewable energy.

How ESG investing can influence returns

A common concern about responsible investing is that incorporating ESG factors into the investment process, or screening out certain companies, may compromise investment performance. But recent research shows responsible investment can make financial sense, with ESG assets under management matching or outperforming mainstream funds over most time frames and asset classes3, despite the impact of COVID-19.

One thing to be aware of is many of these investment options are still relatively new so their long-term performance is hard to gauge at this stage.

What ESG investment options are out there?

If you’re looking to contribute to positive change in the world, the good news is there’s more choice than ever.

The Responsible Investment Association Australasia has now certified over 200 responsible investment products.

But there’s still some way to go to match investment options with consumer preferences.

As well as fossil fuels, consumers tend to care most about human rights abuses and animal cruelty, while investment managers offer products that most commonly exclude tobacco and weapons.

How to get started with responsible investing

If you’re considering making the change to ethical investing, or you’re keen to see how your current investments stack up, here are some steps you can take to get started.

- Think about what’s important to you—everyone’s values are different so identify the areas where you don’t want to see your money invested and the areas where you could put your money to make a positive impact.

- Ask where your money is invested—a good place to start is online, where many super funds or investment managers have information about sustainability and ESG.

- Do your research—there are many responsible and ethical super funds, investment products and fund managers out there.

- Ask for help—if you need assistance finding out what you’re invested in or how to access more ethical investment options, ask your financial adviser.

Investing responsibly with AMP

At AMP we believe sustainability means meeting the needs of the present without compromising future generations.

- We’ve received the top Prime ranking for the way we manage ESG issues in our corporate business, placing AMP in the top 10% globally in our industry4.

- We’re continually monitoring the way we create and protect value for our clients, our people and our community—check out our 2020 Sustainability Report.

- We’ve added an ESG-focused investment option to our AMP Super Fund product menus.

- We’ve developed MyNorth Sustainable Managed Portfolios to help you invest based on your values—to find out more talk to us on |PHONE|.

1 Responsible Investment Association Australasia, From values to riches 2020 Charting consumer expectations and demand for responsible investing in Australia p5

2 Responsible Investment Association Australasia, Responsible Investment Benchmark Report 20121, p5

3 Responsible Investment Association Australasia, Responsible Investment Benchmark Report 2021 p10 figure 10

4 Institutional Shareholder Services. Rating as of 2 June 2021. More information is available on the ISS website.

If you would like to make an appointment with one of the financial planners in the practice call now on |PHONE| to make a time or use our online booking link to book directly with a financial adviser of your choice on a day and at a time that suits you best.

Source: AMP April 2022

Important:

This information is provided by AMP Life Limited. It is general information only and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances and the relevant Product Disclosure Statement or Terms and Conditions, available by calling |PHONE|, before deciding what’s right for you.

All information in this article is subject to change without notice. Although the information is from sources considered reliable, AMP and our company do not guarantee that it is accurate or complete. You should not rely upon it and should seek professional advice before making any financial decision. Except where liability under any statute cannot be excluded, AMP and our company do not accept any liability for any resulting loss or damage of the reader or any other person. Any links have been provided for information purposes only and will take you to external websites. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.